“技術面分析”聽起來比實際的流程復雜得多。它可以稱為“價格分析”,因為這也許是更加準確的描述。使用制圖數據,全球交易者都可以分析其選擇的市場。目標:嘗試確定未來價格變動。對技術面分析師而言,這意味著了解過去的價格變動格局。

價格變動的制圖闡明了買賣雙方之間的可視博弈。註意圖中形成的價格型態如何傾向於重復;技術面交易者試圖確定這些性質的型態並據此為其交易奠定基礎。

分析價格型態實際上非常類似於分析人類行為。雖然人類本質上有時具有不可預見性,但是人類壹般被視為習慣性生物。普通人類會遵循某些模式。若要觀察壹個普通人士出門工作之前的日常例行事務,則他們的行為可能看起來是隨機或沒有目的的。但是,若日復壹日地觀察同壹個人,則在相對較短的時間內,概述這個人每天早晨的例行事務並不難。事實上,您十之八九可以相當準確地預測您觀察的生物會如何準備他們壹天的活動,甚至可以精確到分鐘。

外匯市場有時也被視為習慣性生物。分析價格變動可能是有效的,因為過去可以告訴我們市場將如何回應某些情況。歷史本身會不斷重復。在考慮未來價格變化時,技術面分析為交易者提供了某種程度的預期。我們沒有水晶球可以預測市場的未來,但交易者確定了壹些關鍵因素,可用於理解模式、過去、現在和將來。

技術面分析在交易者未能考慮基本面時會失效。政治事件、利率上調、失業率等基本面因素將影響外匯市場,其顯著程度可能超過任何其他市場。基本面因素通常會推動重大價格變動。關註技術面分析的交易者不可能忽略每月第壹個星期五公布的美國非農就業數據,還期望自己的技術指標與前壹天同樣準確。價格可能在非農就業數據公告後不久反應劇烈;在此期間內,可能無法依賴技術面分析。純粹的技術面交易者理解,某些政治因素會把所有其他的價格預測拋之窗外。

線形圖表是圖表中最簡單的壹種類型。線形圖表的優勢在於其簡單易用,提供對某壹特定期限內證券價格的有序且容易理解的壹覽圖。

條形圖表顯示壹個證券每個時期的開盤價,高價,低價和收盤價。條形圖表是證券圖表最通用的類型。

正如以下條形圖表所示,每個縱條的頂端代表證券在期限內進行交易的最高價格,條形底部代表所交易的最低價格。收盤的“最小升降單位”在條形右邊顯示,指明證券在期限內交易的最後價格。如果開盤價可用,將會以條形左邊的“最小升降單位”表示。

燭柱圖表以類似於現今的條形圖表的格式顯示開盤價格,高價,低價和收盤價,但低估了開盤價和收盤價之間的關系。燭柱圖表僅僅只是觀察價格的壹種新的方式,不用於進行任何計算。 每個燭柱代表壹個時期(例如,壹天)的數據。下圖展示如何閱讀燭柱圖表:

在技術分析中,首先聽到的壹句話往往是“趨勢是妳的朋友”。把握大勢能幫助交易者了解市場的整體方向。每天、每周和每月走勢圖最適合用來研判長期趨勢。判定整體趨勢後,技術型交易者壹般就會開始判別自己選擇的交易時段內的趨勢。

One 在技術分析中,首先聽到的壹句話往往是“趨勢是妳的朋友”。把握大勢能幫助交易者了解市場的整體方向。每天、每周和每月走勢圖最適合用來研判長期趨勢。判定整體趨勢後,技術型交易者壹般就會開始判別自己選擇的交易時段內的趨勢。

Support 支撐點和阻力點指圖表中反復出現上行或下行壓力的價格點位。支撐點在低位出現,而阻力點在高位出現。壹旦突破點位,兩者往往會相互轉化。例如,如果支撐點突破後呈下行趨勢,則該支撐點通常會成為新的阻力點。在升市期間,阻力點突破後可以成為上行趨勢的支撐點;而在跌市期間,支撐點突破後可能成為下行趨勢的新阻力點。

Trend 趨勢線很簡單,對於確認市場趨勢的方向很有幫助。壹條上行直線至少需要連接兩個連續的最低價位點,點位越多越好。每個連續的點位必須比上壹個點位高。這條連續線有助於判定市場移動的軌跡。上行趨勢線是判別支撐線/支撐點的實用方法。按相反方向連結兩個或多個點位則會形成下行線。趨勢線是否有效,部分取決於連結點的數量。

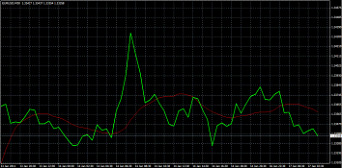

移動平均線對於判定整體趨勢非常有用。移動平均線揭示給定時間段內貨幣在給定時間點的平均價格。稱之為“移動”,是因為它們按相同的時段反映最新平均價格。

A 移動平均線的弱點在於它們滯後於市場,因此未必能在最有利的時間點反映趨勢變化。為解決這個問題,最好的方法是采用較短期限,因為相對於較長期限,較短期 限更能反映最近的價格變動。但與此同時,短期平均移動線也容易產生虛假的趨勢變化信號。因此,使用移動平均線時,最好將兩個不同期間的平均線結合使用。當 短期移動平均線高於長期移動平均線時,壹般屬於買入信號。相反,當短期移動平均線低於長期移動平均線時,則屬於賣出信號。

就方法而言,移動平均線在數學上主要有三種不同的類型,即簡單移動平均線(SMA)、指數移動平均線(EMA)和加權移動平均線(WMA)。在指數移動平均線和加權移動平均線中,最新價格數據所占比重較大;而在簡單移動平均線,期內所有數據所占比重相同。因此,很多交易者更喜歡使用指數移動平均線和加權移 動平均線,以抵消移動平均線信號的滯後性。

價格指標與擺動指標在用途和來源方面有很大區別。價格柱線和燭線上的價格指標包括移動平均線、布林線 (Bollinger Bands) 、拋物線轉向指標 (Parabolic SAR) 和各種其它指標。這些壹般都是滯後指標,反映價格行為的歷史走勢。它們通常能暗示和確認以往趨勢和目前動量的方向。

單獨出現在價格柱線上方或下方的擺動指標也屬於滯後指標。但與價格指標不同,擺動指標對於研判超買和超賣情況非常有效。因此,如果交易者想要研判的是區間盤整行情,而非單邊行情,則最常用的就是這些指標。這些擺動指標包括隨機指標 (Stochastics) 、平滑異同移動平均線 (MACD) 、相對強弱指標 (RSI) 及多種其它指標。

Like 除不包括上述趨勢線和通道外,技術繪圖工具與分析工具類似,其使用很普遍,形式多樣。由於繪圖工具能夠用不同方式呈現斐波納契(Fibonacci)回調線、江恩角度線(Gann Fan)、安德魯音叉線(Andrew's Pitchfork)及其它指標,因此備受交易者推崇。這些繪圖工具大多數用於研判重要區域,包括支撐點和阻力點。趨勢線是最基礎的繪圖工具,包括對角線和水平線。除此之外,其它繪圖工具都較復雜,通常需要以復雜的數學計算為基礎。

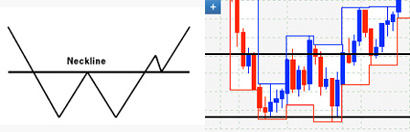

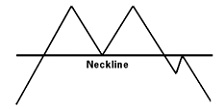

當壹貨幣對呈上漲趨勢且遇阻力點時雙頂便形成了。到達雙頂後,價格開始回落至支撐位,且頸線(Neckline)出現,價格將最終繼續回升至阻力位。在未能突破阻力位後,價格將第二次回落。在頸線(Neckline)價位,價格開始新壹輪下跌。

與雙頂完全相反的稱之為雙底。在價格兩次跌落至支撐位時下跌趨勢開始逆轉。若未能突破支撐位,則價格將開始新壹輪回升。有時貨幣對將再度出現頸線(Neckline),繼而從支撐位轉為阻力位。

典型的三重頂圖形中頭頂位於同壹價格。可將三個最高價位連接成線,形成阻力線。頸線(Neckline)可由連接各支撐位形成。在到達第三個頭位後,價格下滑至頸線(Neckline)以下。市場可能將短期反彈,突破以往頸線,且再進入新壹輪的下滑。

上圖為三重頂的實例。請註意頸線並非呈現常態的水平線,而是呈傾斜上升狀。就這些圖形而言,交易者需運用的熟練技巧將他們從理論形式提煉於現實操作中。

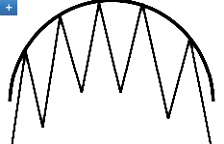

另壹圖形型態圓形頂與圓形底即其反轉線呈“圓弧”狀。圓形頂圖形在市場預期逐漸由牛市平穩過渡到熊市時形成,而圓形底圖形則在市場預期逐漸由熊市平穩過渡到牛市時形成。當市場走勢逐步由上升轉為下跌,價格變化將形成碗狀圖形。

整理型圖形表示的是圖形所代表的價格僅為當前走勢的壹個小停頓,在突破該圖型趨勢後將延續當前走勢。我們將解析下列各圖型暗含的反轉趨勢:旗型圖,矩形圖,三角圖型,及楔型圖。

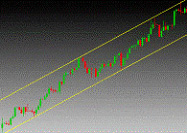

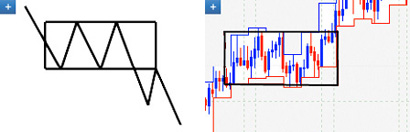

旗型圖所代表的是活躍、漸進市場走勢中的短暫停頓。旗型圖常以壹條明顯、且近乎水平的直線標註成型。旗型圖兩側由兩條平行的支撐位線與阻力位線組成。出現該圖形之後通常伴有明顯的突破,且價格回升至當前趨勢。

旗型圖所代表的是活躍、漸進市場走勢中的短暫停頓。旗型圖常以壹條明顯、且近乎水平的直線標註成型。旗型圖兩側由兩條平行的支撐位線與阻力位線組成。出現該圖形之後通常伴有明顯的突破,且價格回升至當前趨勢。

旗型圖具有形成呈傾斜狀,且與市場走勢的相反的趨勢。

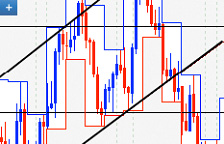

上圖的旗型圖也顯示了長線的下跌趨勢。該趨勢延續了兩個月,未出現新的趨勢。突破支撐位後,最終形成旗型圖,繼而延續了下跌走勢。

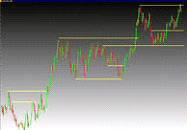

矩形圖表示的是現行趨勢中壹段價格穩定的時期,期間價格在兩條水平線範圍內來回震蕩,最終回到之前走勢。該圖型對未來的交易趨勢並無重大意義----因為矩形圖很少能加快現行趨勢對以往趨勢的改變。盡管矩形圖並不是對主流趨勢起反轉作用的決定性特征,但它為交易者在該區域內交易創造了機會,因為交易者可在價位來回震蕩於阻力位與支撐位的區間內開立交替倉位。

上圖為理論上的矩形圖區間內價位的上升與下跌趨勢。

三角圖型通常是壹種穩定趨勢的特征,隨後伴有與連續走勢相反的加速價格突破。三角圖型包括三種基本類型:等腰三角形,上升三角形,下降三角形,及另壹變形---楔形三角形。

等腰三角形代表的是價格走勢上漲或下降的某壹穩定時期。等腰三角形是由壹條斜向上的支撐位直線與另壹條斜向下的阻力位直線組成。等腰三角形也會出現與之前走勢同向的價格突破,但該情況不常出現。

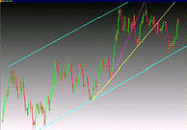

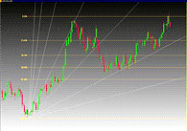

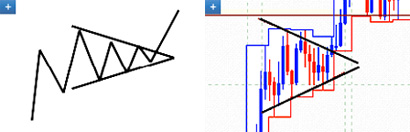

上升三角形代表的是價格走勢上漲的某壹穩定時期,它由壹條相對較平,甚至水平的阻力位直線及另壹條斜向上的支撐位直線組成。

隨著兩條線匯合,價格突破的幾率不斷加大。當價格上漲至大大超過阻力位時,圖型趨勢結束。

上圖右為某日圖表為由連續近壹個月的穩定上漲趨勢形成的上升三角形。

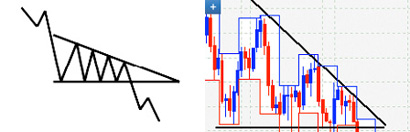

下降三角形代表的是價格走勢下跌的某壹穩定時期,它由壹條斜向下的阻力位直線,及另壹條相對較平,甚至水平的支撐位直線組成。隨著兩條線匯合,價格突破的幾率不斷加大。當價格大幅下跌至支撐位以下時,圖型趨勢結束,且下降趨勢繼續。實例請參看上圖右側。

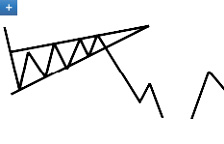

楔形三角形具有等腰三角形與旗型圖的大多特征。楔型圖的形成與三角圖型大致相同,其表明將會出現與現行走勢同向的大幅價格突破。然而,與旗型圖類似的是,楔形本身在出現與現行走勢同向的價格突破前,將形成與當前走勢相反的趨勢。